Hollywood's Next Hit Could Be Based on an NFT -- And You'd Never Know It

In 1994, True Lies was a massive hit, raking in almost $400 million at the box office. That makes sense: It starred Arnold Schwarzenegger, one of the most bankable stars in Hollywood history, and was helmed by James Cameron, fresh off directing Terminator 2.

But how many people watched La Totale, the French movie it was based on?

That's the question on John Wick creator Derek Kolstad's mind. In between writing Netflix's upcoming Splinter Cell show, Kolstad is penning an eight-episode anime show, based on Forgotten Runes Wizard's Cult.

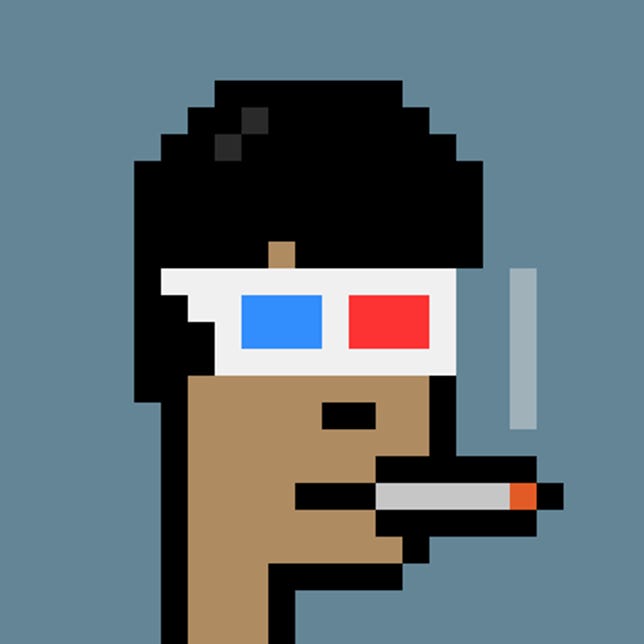

If you've never heard of Forgotten Runes, that's probably because you don't spend your nights surfing NFT marketplace OpenSea. It's an NFT collection that launched last July and consists of just under 10,000 fantasy characters. The question is simple: Is it possible for a show based on NFTs to cross over to a mainstream audience that may not even know what those three letters stand for?

"There's real life and there's what Web3 is doing, and there's a divide between the two," Kolstad said in a recent Zoom interview. "You [need] to bridge the divide by just making a good thing, a good thing that makes people say, 'What is this? It's based on something? What's that?'"

NFT collections, like the Bored Ape Yacht Club, typically feature thousands of different characters, as well as a loose story that ties them together. But NFTs are polarizing. They've been enthusiastically adopted by some, but are despised by many. Those working in the industry are aware that interest is too limited to market NFT adaptations, like a TV show, based on its crypto credentials alone.

But that doesn't mean NFT characters, stories and franchises can't be fodder for an adaptation that goes mainstream. Forgotten Runes is one of many NFT brands hoping to jump from the blockchain to the big screen.

"The number of [NFT owners] in a single collection is usually around 5,000," said Bryce Anderson, production executive at Clubhouse Pictures, which helped produce I, Tonya and Birds of Prey. "If that's your audience, it's not enough to make a global brand. We talk about our TV shows, and it's 500,000 people per week or you get canceled. That's what you need."

It won't be easy. Much of the hype around NFTs was generated by the speculative bubble that enveloped the crypto market in 2021. The crash of crypto prices in recent months has sedated that speculative mania, dampening enthusiasm for NFTs. Despite the cold winds of "crypto winter," many creators are trying to prove that NFTs are here to stay.

Similar to how some developers and engineers left the Silicon Valley giants to join the crypto industry, renowned creatives are exploring NFTs. Most notable are the celebrities. Seth Green is working on a show that will star his Bored Ape Yacht Club NFT. Reese Witherspoon's production house is working on a film and TV universe for the World of Women NFT collection. Equally important are the artists and scriptwriters, who've come from companies like Pixar and Marvel.

"You never know what something's going to become," said Bearsnake, one of Forgotten Runes' founders. Bearsnake declined to give his real name but verified to CNET that he ran creative at an entertainment startup acquired by Disney. "Hello Kitty started as a vinyl coin purse. Did they know it was going to turn into... one of the biggest media franchises in the world? No, but it found an organic way to where it is now."

28 of the NFTs in Forgotten Runes Wizard's Cult, a collection of 9,995 pixelated NFTs.

Fund a show, own a character

For some, the goal is for a universe created from an NFT collection to break through the cryptographic ceiling and go mainstream. Others see NFTs more practically: as a way to help fund productions.

"The biggest barrier for any young filmmaker has been finance," said Spike Lee during a talk at the NFT.NYC conference in June. "Where are you gonna get the money?"

Lee says technology has helped decentralize filmmaking, as amateurs can now shoot and edit video on their phones and laptops. Funding, however, continues to bedevil up-and-coming artists. Lee hopes NFTs can change that. He's piloting a program at New York University, where he teaches filmmaking, that will allow his students to fund projects by issuing NFTs.

"Films are still going to be made by the studios, and I think that NFTs will fit in the independent cinema," Lee said.

At the center of the premise is intellectual property. Punters can invest in up-and-coming filmmakers and the characters they create, just like they can invest in startup companies. The more popular those characters become, in theory, the bigger the returns.

IP bleeds into the second proposed benefit of media creation via the blockchain. Buying an NFT often means buying the IP for the depicted character -- and the right to build on top of that IP by creating a backstory. Many hope this can change the way films and TV are written and created.

Take Forgotten Runes. Wizard's Cult is a collection of 9,995, each depicting a different fantasy character: mages, warriors, alchemists, clairvoyants and more. Those who own an NFT get access to the Book of Lore, wherein they can write an official backstory for their character. Once it's written, it can't be changed -- even if the NFT is sold to another person.

It sounds like a recipe for chaos -- the internet is undefeated at loading unsuspecting platforms with offensive content -- but the idea is that self-interest will prevail. Worthwhile characters can be chosen to appear in Forgotten Runes' upcoming anime. If it becomes a hit, the characters within, and their attached NFT, become more valuable.

Writing fan fiction is technically illegal, points out Bearsnake, as it violates copyright law. The proposition, made by many NFT collections, is that franchises can be built quicker by embracing the passion of fans rather than merely tolerating it.

"Some of my favorite pieces of literature of the last 10 years, like actual literature, is stuff people wrote on the internet, and released on the internet, for free," said Clubhouse Picture's Anderson. "That was their creative impulse, and I think [NFTs help find] a way to let that live in a more public way."

Anderson is cocreator of Runner, an upcoming NFT collection. Runner takes place on a planet called Omega and focuses on The Omega Race, a contest that determines who rules the whole planet. It's being penned by Blaise Hemingway who, through the Disney Animation Story Trust, helped write Frozen and Big Hero 6.

Runner is an upcoming NFT collection. It's founded by Bryce Anderson and Bryan Unkeless, both of Clubhouse Pictures. Between them, they've worked on films like The Hunger Games and I, Tonya.

To Hemingway, the idea of NFT holders being able to create official backstories for their characters reminded him of being a kid and creating storylines for his Star Wars figurines.

"There could be a character that appears on screen for two seconds in a cantina scene, but what's that character's story?" he said. "We're following the story of about 12 central characters, but there's an entire world that has parallel stories going on that intersect with this."

Hemingway and Anderson have plans to adapt Runner to other mediums, though none are concrete yet. A film or TV expression seems inevitable given the team's credentials: Working with Hemingway and Anderson are Bryan Unkeless, producer of the Hunger Games, and Cedric Nicolas-Troyan, director of Snow White and the Huntsman.

NFTs going pop

The business models of NFT collections -- the ones that have business models in the first place -- often rely on the ability to break out into mainstream culture. But breaking out requires quality products, and quality products take a lot of time and effort to make.

Forgotten Runes is among the more ambitious NFT groups. Beyond the anime show, there's a comic book series that had its first issue in June, plans for a tabletop game and, curiously, even a cookbook. A Forgotten Runes massively multiplayer online role-playing game, or MMORPG, is in development and is due for release early next year.

The idea of creating a franchise and expanding it into different mediums is as old as Disney, said Bearsnake. What's new with NFTs is a set of tools that allows fans to play a more crucial role in that process. Those tools, however, create problems as well as solutions. Creators need to make products with mainstream appeal but also placate NFT investors who are mostly speculators, more interested in short-term hype than long-term vision.

"The majority of people in the space are really in it for financial gain, and that's OK," said Bearsnake. "I think there's a lot of unrealistic expectations from a lot of the community to the founders, because not everybody understands what goes into just even making a comic book. Like, that was hard."

It's a difficult time to be branching out. The past few months have been tough on all things crypto. Ether, the currency behind most NFTs, is down over 50% since the year began. That's tanked not only NFT valuations -- Bored Ape Yacht Club NFTs are at about a third of their all-time-high -- but also mainstream interest in the arcane technology.

The circumstances for a blockchain blockbuster aren't the most auspicious, but NFT creators don't need to make the next True Lies. They just need to make the next La Totale.

Source

Tags:

- Hollywood S Next Hit Could Be Based On An Nft And You Don T Seem To Understand

- Hollywood S Next Hit Could Be Based On An Nft And You Drown

- Hollywood S Next Hit Could Be Based On An Nft And You Don T Want That Lyrics

- Hollywood S Next Hit Could Be Based On An Nft Just Sold

- Hollywood S Next Hit Could Be Based On An Original Idea

- Hollywood S Next Hit Could Be Based On An Analysis

- Hollywood S Next Hit Could Be Based On Synonyms

- Hollywood S Next Hit Songs

- Hollywood S Next Hit Mixtape

- Hollywood Squares

- Hollywood Studios Rides