NFTs explained: Why people spend millions of dollars on JPEGs

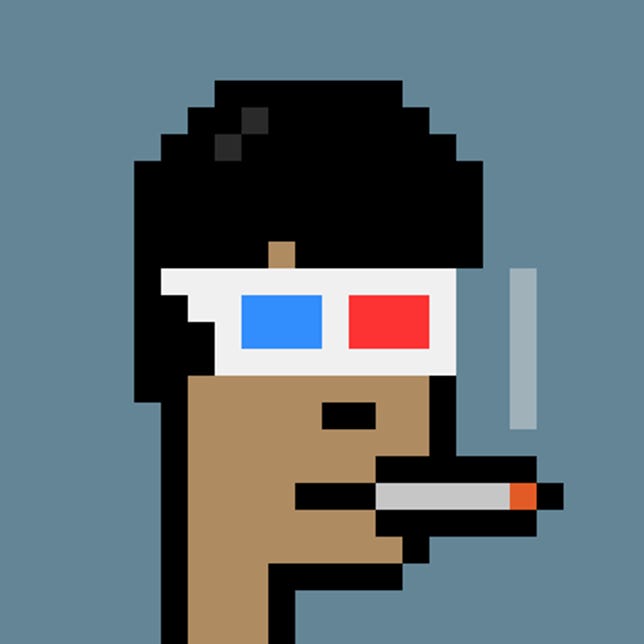

Take a quick look at the image to the right. What, if anything, could convince you that image is worth $9 million?

What you're looking at is an NFT, one of the first ever created. It's part of the CryptoPunks collection, a set of 10,000 NFTs released in 2017, a time when much of the world was still finding out what bitcoin is.

Most likely you've already rolled your eyes, either at the $9 million figure or at the very idea of NFTs themselves. The response to nonfungible tokens hasn't changed much since March when they first started exploding. The public at large has reflexively dismissed them as environmentally harmful scams. The bigger the sale, the more brazen the injustice.

Which brings us back to the above pixelated chap. Its owner is Richerd, an affable Canadian software developer. He started building cryptocurrency software around 2013, but eventually tired of it. After discovering NFTs earlier this year, Richerd bought CryptoPunk #6046 on March 31 for $86,000 in what he said was the biggest purchase he'd ever made in his life.

Richerd, who has over 80,000 followers on Twitter, last month claimed that his CryptoPunk was priceless to him and wasn't for sale no matter the price. The very next day his determination was tested when an offer came through for 2,500 ether, or $9.5 million. It was made not because Richerd's CryptoPunk is worth that amount -- similar NFTs now go for about $400,000 -- but rather because his bluff was very publicly being called. It was a challenge, but it was still a legitimate offer. If Richerd clicked "accept", 2,500 ether would have flowed into his wallet.

Richerd rejected the offer.

"Well, obviously, the day before I said 'I'm not selling it for any price,' so if I sell it for that price, I'd be going against my integrity," Richerd told me over a Zoom call. "On top of that, I've used this CryptoPunk as my profile pic, as my brand. Everyone knows that's me."

Not too long ago, Richerd's explanation would have sounded insane to me. How divorced from reality would someone need to be to offer eight figures on a picture that looks like a Fiverr job? How scandalously misguided would a person need to be to rebuff that offer? After I spent a few months researching and following NFTs, however, it doesn't surprise me in the slightest. In fact, it makes a whole lot of sense.

There are 10,000 NFTs in the Bored Ape Yacht Club collection. Here are three examples. The middle one is owned by Jimmy Fallon.

Yuga LabsBitcoin millionaires

Here is one quick fact that explains why NFTs are bought for the equivalent of a CEO's salary: Bitcoin is estimated to have made over 100,000 millionaires. It's no surprise that NFTs became a phenomenon in March. That's when bitcoin hit $60,000, up over 500% from just six months prior.

When you see a headline or a tweet about some preposterous sum being spent on an NFT, it's easy to become bewildered over how absurd that purchase would be for you. What's easy to forget is that very expensive things are almost exclusively bought by very rich people -- and very rich people spend a lot on status symbols.

Take Bored Ape Yacht Club, for example. It's a collection of 10,000 ape NFTs, all with different traits that make some rarer than others. Rare ones have sold over for over a million bucks, but common variants go for around $200,000. (At the time of launch back in April, BAYC developers sold the NFTs for $190 each.) BAYC, owned by the likes of Steph Curry and Jimmy Fallon, is what you'd call a "profile pic collection." The main purpose of the images is to be used as your display photo on Discord, where most NFT business goes down, or on Twitter, Instagram or wherever else.

To recap: $200,000 minimum for a profile picture.

In isolation, that's insane. But place it on a spectrum of how wealthy people spend money, and it becomes less staggering. You can right click and save a JPEG, so why spend money on it? Well, you can buy a nice house in a safe neighborhood almost anywhere in the world for $1 million, yet celebrities regularly snap up $20 million mansions. You can find a fashionable dress for under $500, yet brands like Chanel build their business on selling ones for 20 times that amount.

Up to 100,000 people became millionaires when that green line shot skyward.

coinmarketcap.comWe accept that rich folks buy extravagant items offline. Is it so inconceivable they would buy extravagant things online, too?

"In the real world, how do people flex their wealth?" said Alex Gedevani, an analyst at cryptocurrency research firm Delphi Digital. "It can be buying cars or watches. How scalable is that versus if I buy a CryptoPunk and use it as my profile picture?"

Obviously, status symbols aren't specific to the rich. All of us indulge in some way or another, be it buying a $20,000 new car when a $7,000 used vehicle will do, or buying a $30 T-shirt when Walmart sells basics for under $5. What most status symbols have in common is that they have a specific audience in mind. The banker sporting his Rolex and the chief executive stepping into her Bentley don't care that I think either of those purchases is excessive. They have a small but powerful group of people they're trying to influence. So, too, with NFTs.

In the case of Richerd, he runs his own business, Manifold, where he helps show digital artists like Beeple how they can use blockchain technology to make art that could only exist as NFTs. Being a part of the most sought-after NFT collection helps in those circles. And when he says his brand is built on his Punk, he's not exaggerating -- a group of investors even named their organization after him.

"Anybody who owns a CryptoPunk believes certain things," Richerd explained. "Either you've been in the community for a long time so you believe in what these are, or you've paid a lot of money to get in, which shows conviction.

"I want to show my conviction. This is one of those projects that makes you put your money where your mouth is."

A bit of trouble

NFTs are polarizing. There's a small group of people who believe in the underlying technology (tokens that prove ownership of a digital good), but there are many more who regard it as a hoax. Just as the second group struggles to see any value in NFTs, the first group can sometimes be defensive about the technology's imperfections.

And make no doubt about it, there are a lot of issues with NFTs.

First is the confounding inaccessibility. There's a reason software developers tend to do well in crypto and NFT trading: Setting up blockchain wallets and other required digital apparatus is difficult. Even just buying and selling can be perilous. Send money to the wrong wallet address by accident, and it's gone forever.

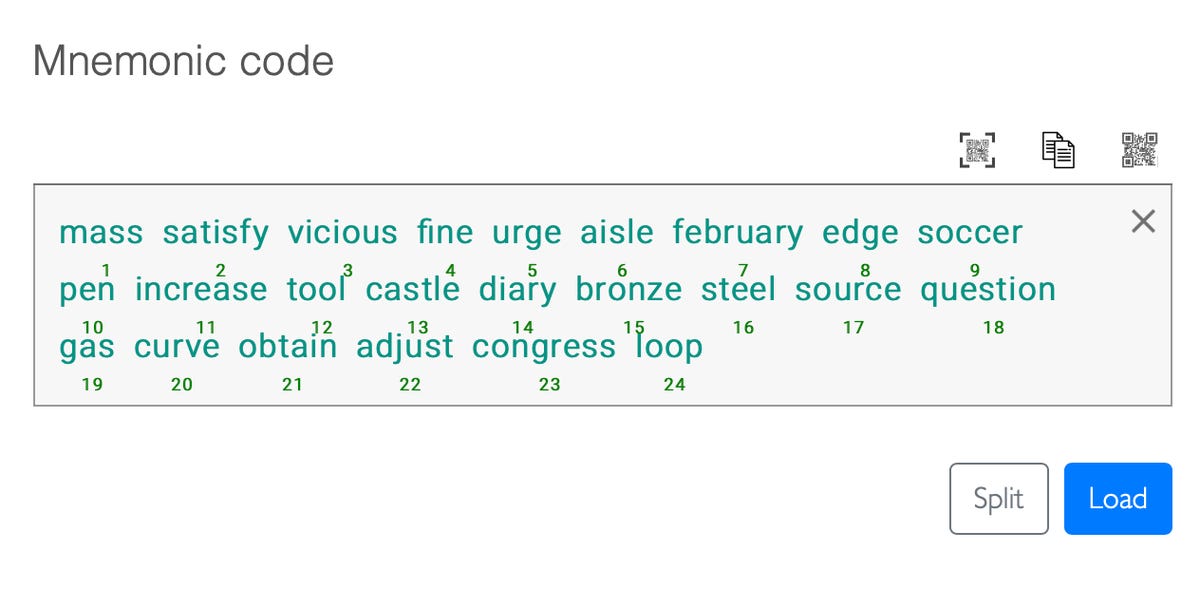

Then there are the fees. Imagine you're interested in dipping your toes into nonfungible waters and you have $1,000 you're willing to lose. If you're minting a new NFT during a public sale you'll usually spend between $120 and $400. Not too bad -- until you factor in the transaction fees. Most NFTs are built on the ethereum blockchain, which is notoriously inefficient. The more people using ethereum, be it through trading altcoins or buying NFTs, the higher the fees. At a good time you'll spend about $100 per transaction, though double or triple that amount is common. Suddenly that $1,000 doesn't go very far.

This is especially troublesome for NFTs, which are infamous for causing "gas wars." It's possible for 100,000 people to buy shiba inu coins at once, since there are a quadrillion in circulation. But when 10,000 people try to buy an NFT, it results in a massive spike in transaction costs as some users outbid each other to speed up their purchase. It may only last a minute or two, but a lot of damage can be done in that time. People spending over $10,000 on a transaction fee isn't rare. People losing $1,000 on a failed transaction isn't, either.

This is what it looks like when someone spends $4,000 on a failed transaction. It's rare, but not rare enough.

Etherscan screenshot by Daniel Van BoomEthereum's inefficiency also contributes to the other major criticism of NFTs, the massive amount of energy they consume. Note that this is something of a semantic issue: NFTs aren't bad for the environment as much as ethereum is. Other networks, like Solana, use a fraction of the power. Ethereum developers are expected to implement an upgrade next year that will make mining it consume 1% the energy it currently does. At this moment though, while no one can say precisely how much energy ethereum consumes, we know it's a lot. (Bitcoin, despite getting all the headlines, is even less efficient than ethereum, which is why almost nothing is built on its blockchain.)

And finally, there's the fact that most people trading NFTs are doing so to make a profit. Scams are everywhere, and prices are volatile. Most of the people who create, buy and sell NFTs are ignorant or uninterested in the technology. If there is a technological leap taking place, it's likely to be obscured by the dizzying price movements.

"I'd call it a bubble," Gedvani said, "because the amount of speculators that are entering the market is outpacing genuine creators."

But a bubble can pop and leave something better in its wake. Think of Pets.com. It had a peak valuation of $290 million in February 2000 but by November of that year, as the infamous dot-com bubble began to burst, it had already closed shop. It's used as a cautionary tale for speculative trading in bubbles. But the impulse to invest in Pets.com evidently ended up being justifiable. That particular venture was misguided, but the e-commerce trend it was flicking at was legitimate. Seven-figure pixel art may not be forever, but proof of digital ownership, which is what NFTs are really about, may be.

A big 2022

Where NFTs will end up is anyone's guess -- and anyone who claims to know is probably trying to sell you something. What we do know is that the amount of people buying NFTs is almost definitely about to grow.

It's estimated that around 250,000 people trade NFTs each month on OpenSea, the biggest NFT marketplace. In the short term, CoinBase will soon open its own NFT marketplace, for which 2 million users are on the waiting list. Robinhood has similar plans.

More importantly, giant companies that already make money outside of the crypto space want in. Niantic, the company behind Pokemon Go, has just announced a game in which players can earn bitcoin. Twitter and the company formerly known as Facebook plan to integrate NFTs into their platforms, and Epic Games says it's open to doing so too. Envision a world where instead of buying skins in Fortnite, you buy an NFT for those skins that you own -- meaning you can trade it for outfits and weapons in other games, or sell it once you're done with it. (Epic said it won't integrate such a mechanic into Fortnite, but that may not stop competitors.)

Richerd reckons the flood of people soon to enter the NFT marketplace will create a broader diversity of digital products sold for different audiences. Your neighbor might not want to spend $200 -- much less $200,000 -- on a profile picture, but maybe they'll be willing to spend $10 on a one-of-a-kind skin, or on a product in Facebook's Metaverse. But though the space may change, he remains confident that CryptoPunk #6046 is safe for a while yet.

"Even if every NFT falls," he said, "CryptoPunks will be the last one."

Source