This story is part of War in Ukraine, CNET's coverage of events there and of the wider effects on the world.

As Russia's war on Ukraine intensifies, the US and its allies have continued to increase their economic pressure on the Russian government, to isolate the country further from the global financial system and debilitate its military capacity. Western allies have frozen Russian assets abroad, removed Russian banks from international banking networks and even banned all gas and oil imports, among other unprecedented penalties. But there's still growing concern that Russian President Vladimir Putin and his supporters might turn to cryptocurrencies to avoid economic sanctions.

With their ability to operate as alternatives to the traditional financial system, cryptocurrency exchanges -- digital marketplaces where you can buy and trade digital currencies -- have become an effective option both for Ukraine supporters to raise funds for relief efforts and for ordinary Russians to seek financial shelter from the economic sanctions imposed on their country.

That's why both the Ukrainian government and advocates for even further economic penalties against Russia have become increasingly vocal about the role crypto exchanges can play in the conflict. Hundreds of Western businesses, such as oil companies Shell and BP and tech players Netflix and Microsoft, have scaled back or halted their dealings in Russia since the beginning of the war. And some people argue that similarly stopping crypto operations in the country could significantly weaken Putin's hold on Russia's economy and its citizens.

"I'm asking all major crypto exchanges to block addresses of Russian users," Ukraine's vice prime minister and minister of digital transformation, Mykhailo Fedorov, tweeted Feb. 28. "It's crucial to freeze not only the addresses linked to Russian and Belarusian politicians but also to sabotage ordinary users."

Fedorov also sent letters to eight cryptocurrency exchanges, including two of the largest by volume, Coinbase and Binance, asking them to stop offering service to Russian users out of concern digital currencies are being used to evade sanctions.

The response was swift.

"We are not preemptively banning all Russians from using Coinbase," CEO Brian Armstrong tweeted March 3. "We believe everyone deserves access to basic financial services unless the law says otherwise." And hours after getting Fedorov's letter, a Binance spokesperson told CNBC, "We are not going to unilaterally freeze millions of innocent users' accounts. Crypto is meant to provide greater financial freedom for people across the globe. To unilaterally decide to ban people's access to their crypto would fly in the face of the reason why crypto exists."

But the CEOs of several exchanges, including some that got Fedorov's letter, said that though they'll continue to offer access to ordinary Russians, they're complying with US law in regard to sanctions. On March 7, Coinbase reportedly said that to facilitate sanctions enforcement, it had blocked more than 25,000 wallet addresses related to Russian individuals or entities thought to have engaged in illicit activity and had reported them to the US government.

Ukraine's request for an all-out ban on Russian users, and the unequivocal rejection from most regulated crypto exchanges, has sparked a debate about the responsibilities digital currency platforms have in an international conflict. As a growing number of Western companies decide to stop conducting business in Russia, should crypto exchanges follow suit and go beyond what they're required to do by law? And even if they did, would banning all Russian users from crypto exchanges make a difference in slowing down Russia's invasion of Ukraine?

Some crypto specialists interviewed by CNET, including executives from crypto companies and public officials working to prevent Russia from using digital assets to sidestep economic sanctions, said a full Russian ban from crypto platforms could do more harm than good in regard to ordinary Russians. And some said the volume of the whole crypto market is still too small to really help Putin's government counter the impact of Western economic penalties, even if it tried.

But other experts on the role the private sector can play in global conflicts said bringing the Russian economy to a standstill is the one nonmilitary way to thwart Putin's advance on Ukraine, and that crypto exchanges can contribute to that only if they stop operating in Russia altogether.

Cryptocurrencies are digital assets that are recorded on a blockchain, a distributed digital ledger that can't be altered. They usually aren't backed by an underlying asset, such as fiat currency. That's why they could be an ideal safe haven amid a wave of economic sanctions.

Why crypto exchanges won't budge on Russia

In refusing to kick ordinary Russians off their platforms, cryptocurrency exchanges argue that the move would further hurt Russian citizens who are suffering from the economic impact of the war and who might consider buying cryptocurrencies as a way to protect their financial standing.

"We all saw those photos of runs on ATMs from Russian citizens -- lines around the block in Moscow," said Todd Conklin, counselor to the deputy secretary of the US Treasury Department. "One would suspect ordinary citizens may have been looking for an alternative to the ruble." Conklin made the remarks during a March 4 webinar hosted by blockchain analytics company TRM Labs about the possibility Russia could use cryptocurrencies to avoid economic sanctions.

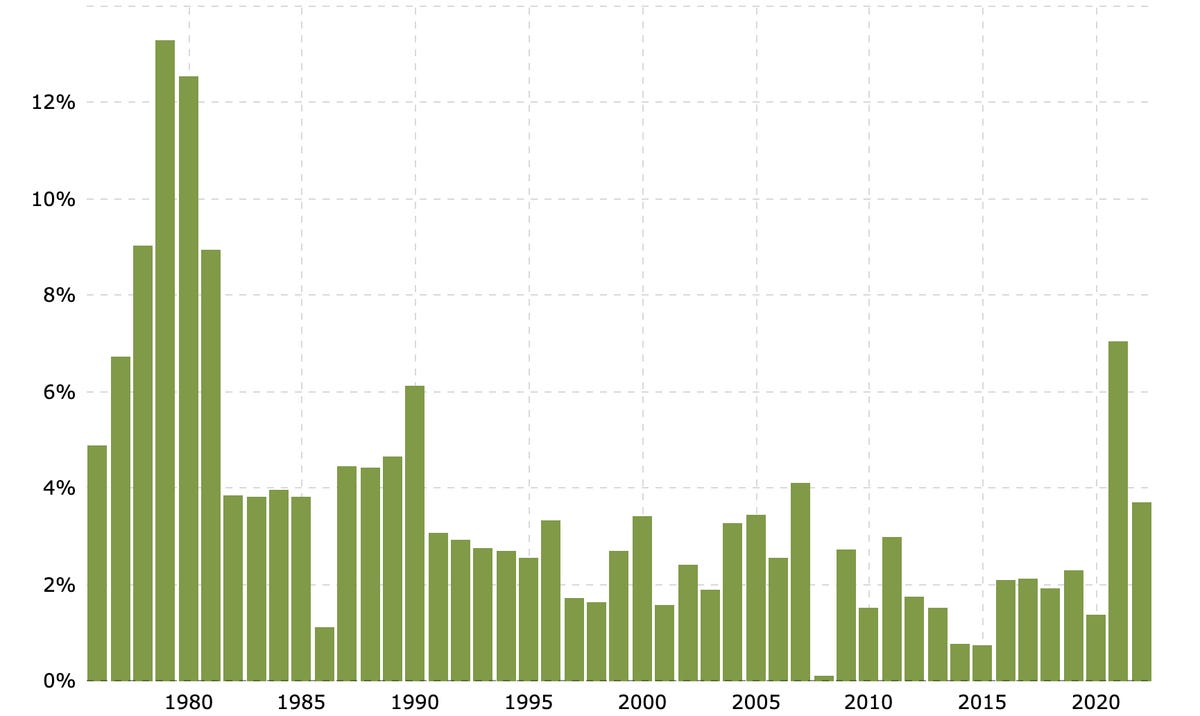

The ruble, Russia's national currency, has lost nearly 50% of its value against the US dollar since the start of the year, according to Reuters. Other parts of Russia's financial system have also been impacted by the West's pressure on the country to stop its aggression on Ukraine. Digital payment services such as Apple Pay, Google Pay and Samsung Pay aren't available in Russia any longer. Visa, Mastercard and PayPal also halted operations in the country. Ordinary Russian citizens, worried that economic sanctions will devastate the Russian economy even further, have flocked to ATMs and banks, seeking to withdraw as much cash as possible before it might be too late.

"Some ordinary Russians are using crypto as a lifeline now that their currency has collapsed," Armstrong, the Coinbase CEO, tweeted. "Many of them likely oppose what their country is doing, and a ban would hurt them, too."

As long as US crypto businesses are complying with US laws in ensuring that sanctioned individuals or entities aren't using their platforms, "crypto could be a vital lifeline for ordinary Russians to preserve their savings [and] receive familial remittances," Michael Parker said in an email. Parker is a former federal prosecutor who's now head of anti-money laundering and sanctions practice at Ferrari & Associates, a Washington, DC-based law firm.

Jesse Powell, co-founder and CEO of Kraken Exchange, another crypto platform, tweeted that though he understood the rationale behind Ukraine's request to remove all Russians from crypto exchanges, Kraken "cannot freeze the accounts of our Russian clients without a legal requirement to do so."

"I would guess that the vast majority of crypto holders on @krakenfx are anti-war," Powell tweeted. "#Bitcoin is the embodiment of libertarian values, which strongly favor individualism and human rights."

Given the anti-authority libertarian streak that fuels so much of the cryptocurrency sector, the refusal from crypto exchange executives to stop operations in Russia isn't surprising, said Yale University professor Jeffrey Sonnenfeld, who's the president of the Chief Executive Leadership Institute, a nonprofit focused on CEO leadership and corporate governance.

Crypto executives don't like "being told what to do," Sonnenfeld said. "And yet, there's a striking naivete [in] that they are working in support of [Putin], the greatest autocrat alive today, the most restricted world leader, [who] they are tacitly supporting by enabling a bypass, if it's even for the cognoscenti, for elites and for oligarchs, if it was as limited as some claim."

Sonnenfeld said that the reason more than 300 Western companies have pulled out of Russia so far isn't that the government told them to do so. "It's the maverick streak of these CEOs who pulled out and started this thundering herd," he said, "courageous CEOs who had the moral character to pull out."

What a full ban on Russia would and wouldn't do

Some specialists said that blocking all Russians from crypto would not only potentially inflict damage on millions of innocent citizens, but it would also do little to amplify the West's sanctions on Russia's economy. The reason? Russia doesn't have the digital infrastructure to tap into crypto assets at a level required to outmaneuver the economic penalties already imposed by the US and its allies.

"You can't flip a switch overnight and run a G20 economy on cryptocurrency," Conklin said during the webinar hosted by blockchain intelligence company TRM. He explained that in recent years, Russia has worked to bolster the ruble and build up its reserves, instead of laying the rails needed to support crypto. That's why US economic sanctions have been focused on preventing Russia from accessing the reserves it keeps overseas. "Big banks in an economy need real liquidity," Conklin said. "Conducting large-scale transactions in virtual currency is likely to be slow and expensive."

Anthony Citrano, founder of Los Angeles-based NFT platform Acquicent, pointed to crypto prices as a clue to what's going on. "If the Russian government really were using crypto as a major piece of their international finance strategy, you'd expect to see absolutely explosive growth in prices of major crypto [currencies]," he said, "which we have not seen. Time will tell, but for now there is zero evidence this is happening."

Former federal prosecutor Ari Redbord, who's now head of legal and government affairs at TRM, said the economic sanctions levied so far have been so "serious and so draconian in their measures" that Russia would need much more than crypto assets to counterbalance them. "We're talking about [the] potential loss of, or no access to, hundreds of billions of dollars in frozen [Russian] Central Bank assets. We're talking about $1.5 trillion in potential trade losses," he said. "The entire crypto market cap doesn't approach what ultimately Russia would need to prop up a G20 [economy] government and fight what is going to become a more and more costly war."

But that doesn't mean the Russian government or Putin's supporters won't try to use crypto to circumvent economic sanctions. "Russian actors are very adept at money laundering and have been for a long time," Redbord said. In the case of crypto, they'll be looking for "noncompliant exchanges in order to move those funds."

Such exchanges include platforms like Suex, which was blacklisted by the Biden administration in September for allegedly helping launder ransomware payments. TRM has identified about 340 exchanges that are either in Russia or Russia-related and don't have compliance controls in place, "and that is where illicit actors will look to move on as on-ramps and off-ramps for crypto," Redbord said.

Those digital platforms are already operating outside the law, though. For any US business, including businesses in the crypto industry, "there is still a full compliance obligation to not deal with sanctioned parties or interests in blocked property," said Parker, from Ferrari & Associates. "US crypto businesses must, and largely do, institute robust compliance programs, including advanced analytics software, to ensure legal compliance with US sanctions."

Bringing Russia to a standstill

Yale's Sonnenfeld argues that it's beside the point whether Putin and his supporters can actually get their hands on enough digital assets to offset the impact of Western sanctions. He said that by halting all operations in Russia, crypto exchanges could contribute to putting even more pressure on Putin's government, until it reaches a tipping point.

"Government-ordered sanctions have limits," Sonnenfeld said, even if they're a coordinated effort between multiple international actors, including the US, the EU, the UK, Australia, Japan and the UN. "They work best when voluntary efforts of the private sector rally."

That's what happened in South Africa in the late 1980s, Sonnenfeld said, when international pressure contributed to putting an end to apartheid, a system of institutionalized racial segregation that had ruled the country for more than 40 years. Economic sanctions imposed by the US government had an effect only when dozens of major private companies joined in. "It brought civil society to a stop/standstill," he said.

Sonnenfeld and his research team at Yale compiled a list of companies that continued operating in Russia following its invasion of Ukraine. After the publication of a Washington Post story that mentioned that McDonald's and Starbucks were on the list, both chains announced plans to stop operating in Russia. Since the list was created and made public, it now shows "over 330 companies [that] have announced their withdrawal from Russia in protest" of the Ukraine war.

For Sonnenfeld, paralyzing Russia's economy is the only nonmilitary option the West has against Putin's advances on Ukraine.

"The humanitarian thing to do is to not go with bombs and bullets, and to strangle civil society" and dissolve Putin's image of being a totalitarian with full control over all sectors, he said. "If you can show him to be truly impotent over the economy, that he doesn't have control over civil society, then he and the oligarchs fall flat on their face, and that's what cryptocurrency mavericks can do" should they decide to halt operations in Russia. "They can be really helpful here."

Allowing ordinary Russians to have access to digital assets through crypto exchanges is "not doing anything humanitarian," Sonnenfeld said. "People should be thrown out of work, they should be out on the street" due to an economic collapse brought on by government-ordered sanctions and to private companies denying Russian citizens access to services, goods and money. "Is that cruel?" Sonnenfeld said. "No, it is better than shooting them, than bombing them -- and that's the stage we're at right now."