Stock Market Secrets: My Smartest Investment Tips After 16 Years of Reporting

This story is part of Recession Help Desk, CNET's coverage of how to make smart money moves in an uncertain economy.

If there's one thing I've learned in all my years of reporting, it's this: The stock market is moody.

In 2006, I began a new role as a financial correspondent reporting from the trading floor of the New York Stock Exchange. My job was to make sense of why the market was up or down each day. I'd start out each morning interviewing mostly older, white male brokers who were in charge of buying and selling shares on behalf of large institutional investors. (Also true: I was required to wear closed-toe shoes and a blazer. The dress code then was strict and a bit ridiculous.)

I learned if tech stocks slumped just after the market opened, it might have been due to lower-than-expected earnings the evening before from an industry giant like Apple. Any hint of turbulence in the tech sector induced panicked brokers to drop shares at the opening bell.

The market doesn't actually reflect reality. It measures the moods and attitudes of people like the brokers I used to interview.

"Today's stock prices aren't because of how businesses are performing today," said Matt Frankel, a certified financial planner and contributing analyst for The Motley Fool, in an email. "They are based on future expectations."

That's the problem: Current prices serve as a gauge of investor confidence, but stock market predictions are, at best, educated guesses. And to further complicate matters, "the markets are not always correct," according to Liz Young, head of investment strategy at SoFi.

Reporting from the floor of the NYSE during the May 2010 "flash crash," when major stock indices crashed and then partially rebounded within an hour.

Screenshot/CNETSound discouraging? I hear you, but it's still worth investing. Here's why.

While the stock market represents an elite class of investors (the wealthiest 10% of Americans hold 89% of stocks), it has proven over time to be a reliable way to grow your money for anyone with the tools and information to try. And technology has made it cheaper and easier to access. Now, a whole new generation has the chance to start investing and building wealth. If you can afford your basic needs and have some emergency savings set aside, there's no better time than now to invest -- even if it's just $20 a month.

Of course, the stock market feels particularly risky right now and it's natural to want to safeguard your money when the economy is volatile. If you're on the fence about investing because you're worried about a recession, or you just don't feel comfortable taking financial risks right now, you're not alone. Over 40% of Americans surveyed earlier this spring said that the bear-market downswing made them too scared to invest.

But waiting to invest is an even bigger risk. Here's what I know for sure about how to overcome worry and invest for success.

The 'Right Time' to Invest Is Right Now

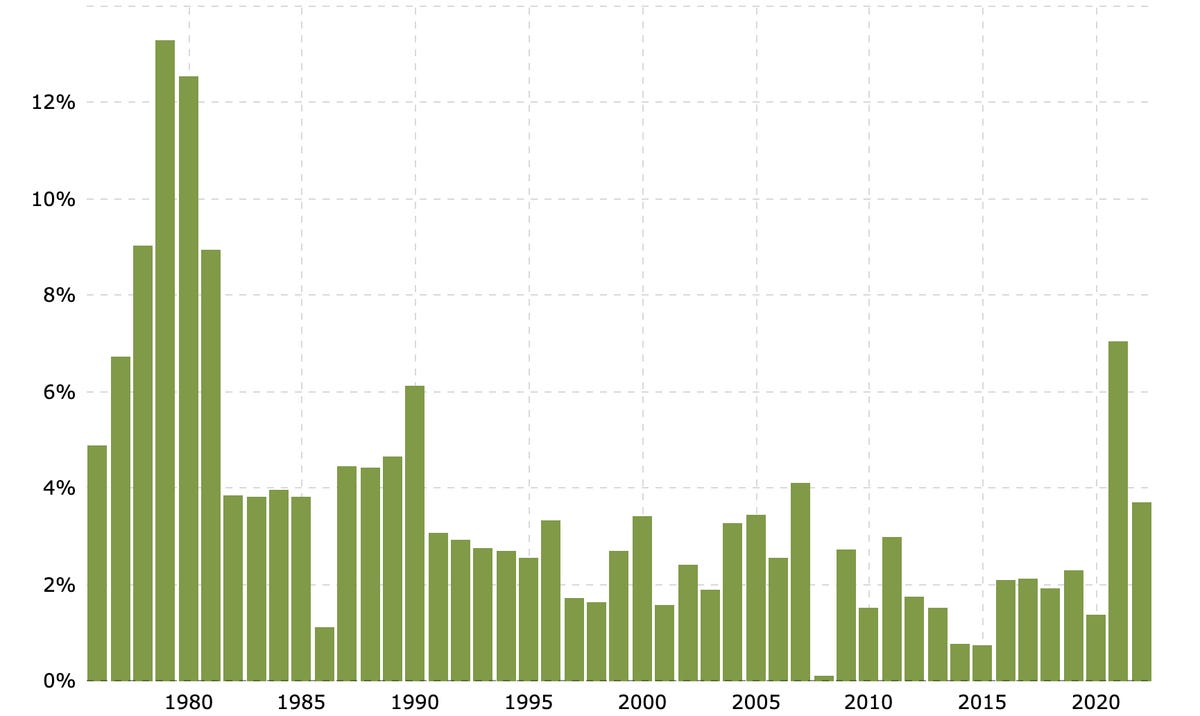

Yes, the market is risky. Yes, there will be more crashes. But there's a high probability that the market will recover, just like it bounced back (and then some) a few years after the 2007-09 global financial crisis.

"Things will get better again. They always do," as my friend David Bach, author of the New York Times bestselling book The Automatic Millionaire told me on my podcast So Money.

Sure, it's better to buy at a low price so that you can cash in later from as much appreciation, or compound interest, as possible. But since it's very hard to predict where prices will go, the "right time" to strike is often something we only realize in hindsight. Waiting to invest until the time feels right, when you think stocks have hit a "bottom," can set you up for more failure than success.

Your time in the market is more important than timing the market. Lying low until stocks rebound just means you're going to pay more. Instead, invest consistently and continuously, and let compounding interest build. You'll buy the dips and the highs, but ultimately, over the years, you'll come out ahead. "If you're in your 30s, or your 40s, or your 50s, and you're not retiring in the next year or two, guess what? Everything's on sale," Bach said.

For example, had your parents invested $1,000 in the year 1960, it would be worth close to $400,000 today. That's after a presidential assassination, multiple wars, a global pandemic and many recessions, including the Great Recession. If the past is any indicator of the future, it's proven that markets will eventually recuperate from a downturn, and that they have greater periods of growth than decline.

Read more: Investing for Beginners

Diversification is your best tool against volatility and market tumbles. Investors who are more cautious could try US bonds, which are considered "safe haven" investments because they are backed by the Treasury and offer a predictable return.

Right now, with inflation at 8.5%, Americans are flocking toward Series I Savings Bonds, a government-issued investment that's protected against inflation. I bonds have both a fixed rate and an inflation rate that's adjusted every six months. Right now, I bonds will deliver a 9.62% annualized interest rate, which means they'll get you higher guaranteed returns than any other federally backed bank account.

Technology Makes Investing Cheaper and More Accessible

Investing can be unnecessarily complicated and exclusionary, and the financial industry as a whole can do a lot more to break down barriers to entry. Guests on my podcast So Money, especially women, people of color and young adults, have shared how they wish they'd learned about investing sooner.

My advice? Lean on technology, as well as the proliferation of social media and podcasts, to gain better access and education. At CNET, we are big fans of robo-advisors, such as Wealthfront and Betterment, that provide low-cost portfolio management. There's no need to wait until you have $1 million in the bank, which is what some professional investment advisors require before working with clients. You can start with just a little cash.

And whether you're a fan of TikTok, Instagram or YouTube, there are some reputable experts there offering free education. One cautionary tip: Be sure to check their backgrounds and ensure whomever you're following is not a salesperson disguised as an investment educator!

Read more: Investing Doesn't Have to Be Intimidating. Pros and Cons to Robo-Advisors

Once you're investing, embrace automation so you never go astray. Automating our savings or retirement contributions is a smart move that, honestly, saves us from ourselves. With money in our hands, it's much easier to spend than it is to save, but technology can automatically move that money into an account. We're more likely to save for our future if we're already enrolled in a company retirement plan as opposed to choosing to opt in with each paycheck. Start your contribution with the maximum employer-match rate and try to increase your contribution to 10% or even 15%. That could net you thousands of dollars more each year.

Pro-tip: If you're saving for retirement, see if your plan provider will automatically increase your savings rate each year (60% of employers offer this feature, according to the American Benefits Council).

For all other types of long-term investments such as a brokerage account or Roth IRA, create a calendar reminder at the beginning of the year or on your birthday to increase your contributions.

Read more: Need to Save for Retirement? This Is the Easiest Way

You may also be able to set your portfolio to auto-rebalance so that it adjusts and automatically scoops up more stocks after a down period in the market, which can give you the right balance of stocks and bonds in your portfolio.

Auto-rebalancing is a feature many banks and brokerages offer to ensure your portfolio's allocation doesn't fall off-kilter, says David Sekera, chief US market strategist for MorningStar. For example, let's say you set up your portfolio to have an equal mix of stocks and bonds. A bear market like the one we're in now may reduce the weight of stocks and be too heavy with bonds. But an auto-rebalance can fix that by buying more stocks when prices are low again, according to Sekera.

I've seen first-hand how market volatility is creating a lot of uncertainty, and I know why it's hard to feel confident about investing. But history shows that staying on the sidelines as an investor can be riskier than participating in the market and riding out the dips and highs.

Getting into the market sooner rather than later can be one of the smartest decisions on the road to building personal wealth and economic security. Along the way, be mindful of your risk tolerance, stay diversified and rely on automation to help you stay the course.

Source

Tags:

- Stock Market Secrets My Smartest Investment Tips After 16 Candles

- Stock Market Secrets My Smartest Investment Tips After 16 Hours

- Stock Market Secrets My Smartest Friend

- Stock Market Secrets Mysteries Of Christopher Columbus

- The Little Black Book Of Stock Market Secrets

- Stock Market Today

- Stock Market Today Results

- Stock Market Holidays 2022

- Stock Market Crash