Mortgage Interest Rates for Sept. 1, 2022: Rates Climb

Some important mortgage rates increased today. The average 15-year fixed and 30-year fixed mortgage rates both grew. For variable rates, the 5/1 adjustable-rate mortgage also floated higher.

Though mortgage rates have been rather consistently going up since the start of this year, what happens next depends on whether inflation continues to climb or begins to retreat. Interest rates are dynamic and unpredictable -- at least on a daily or weekly basis -- and they respond to a wide variety of economic factors. Right now, they're particularly sensitive to inflation and the prospect of a US recession. With so much uncertainty in the market, if you're looking to buy a home, trying to time the market may not play to your favor. If inflation rises and rates climb, this could translate to higher interest rates and steeper monthly mortgage payments. For this reason, you may have better luck locking in a lower mortgage interest rate sooner rather than later. No matter when you decide to shop for a home, it's always a good idea to seek out multiple lenders to compare rates and fees to find the best mortgage for your specific situation.

30-year fixed-rate mortgages

The average 30-year fixed mortgage interest rate is 5.95%, which is an increase of 3 basis points compared to one week ago. (A basis point is equivalent to 0.01%.) The most common loan term is a 30-year fixed mortgage. A 30-year fixed rate mortgage will usually have a smaller monthly payment than a 15-year one -- but usually a higher interest rate. You won't be able to pay off your house as quickly and you'll pay more interest over time, but a 30-year fixed mortgage is a good option if you're looking to minimize your monthly payment.

15-year fixed-rate mortgages

The average rate for a 15-year, fixed mortgage is 5.19%, which is an increase of 11 basis points from the same time last week. Compared to a 30-year fixed mortgage, a 15-year fixed mortgage with the same loan value and interest rate will have a higher monthly payment. But a 15-year loan will usually be the better deal, if you're able to afford the monthly payments. These include typically being able to get a lower interest rate, paying off your mortgage sooner, and paying less total interest in the long run.

5/1 adjustable-rate mortgages

A 5/1 ARM has an average rate of 4.42%, a climb of 9 basis points compared to a week ago. For the first five years, you'll usually get a lower interest rate with a 5/1 adjustable-rate mortgage compared to a 30-year fixed mortgage. But you could end up paying more after that time, depending on the terms of your loan and how the rate adjusts with the market rate. If you plan to sell or refinance your house before the rate changes, an adjustable-rate mortgage could make sense for you. If not, shifts in the market could significantly increase your interest rate.

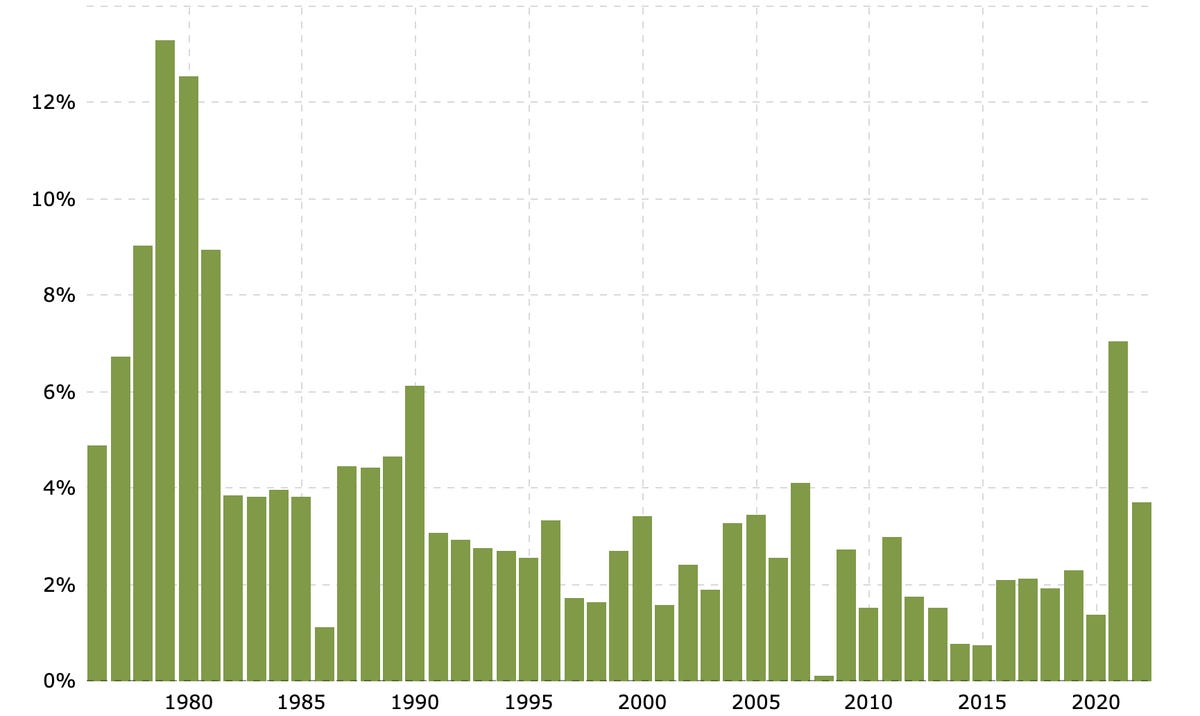

Mortgage rate trends

Though mortgage rates were historically low at the beginning of 2022, they have been rising somewhat steadily since then. The Federal Reserve recently raised interest rates by another 0.75 percentage points in an attempt to curb record-high inflation. The Fed has raised rates a total of four times this year, but inflation still remains high. As a general rule, when inflation is low, mortgage rates tend to be lower. When inflation is high, rates tend to be higher.

Though the Fed does not directly set mortgage rates, the central bank's policy actions influence how much you pay to finance your home loan. If you're looking to buy a house in 2022, keep in mind that the Fed has signaled it will continue to raise rates, and mortgage rates could increase as the year goes on. Whether rates follow their upward projection or begin to level out hinges on if inflation actually slows.

We use data collected by Bankrate, which is owned by the same parent company as CNET, to track changes in these daily rates. This table summarizes the average rates offered by lenders across the country:

Current average mortgage interest rates

| Loan type | Interest rate | A week ago | Change |

|---|---|---|---|

| 30-year fixed rate | 5.95% | 5.92% | +0.03 |

| 15-year fixed rate | 5.19% | 5.08% | +0.11 |

| 30-year jumbo mortgage rate | 5.94% | 5.93% | +0.01 |

| 30-year mortgage refinance rate | 5.92% | 5.85% | +0.07 |

Updated on Sept. 1, 2022.

How to find personalized mortgage rates

When you are ready to apply for a loan, you can reach out to a local mortgage broker or search online. When researching home mortgage rates, take into account your goals and current financial situation. A range of factors -- including your down payment, credit score, loan-to-value ratio and debt-to-income ratio -- will all affect your mortgage interest rate. Generally, you want a higher credit score, a larger down payment, a lower DTI and a lower LTV to get a lower interest rate. Apart from the mortgage rate, additional costs including closing costs, fees, discount points and taxes might also impact the cost of your home. Be sure to comparison shop with multiple lenders -- including credit unions and online lenders in addition to local and national banks -- in order to get a mortgage that's the right fit for you.

What's the best loan term?

One important thing to consider when choosing a mortgage is the loan term, or payment schedule. The most common mortgage terms are 15 years and 30 years, although 10-, 20- and 40-year mortgages also exist. Mortgages are further divided into fixed-rate and adjustable-rate mortgages. For fixed-rate mortgages, interest rates are set for the life of the loan. Unlike a fixed-rate mortgage, the interest rates for an adjustable-rate mortgage are only set for a certain amount of time (commonly five, seven or 10 years). After that, the rate adjusts annually based on the current interest rate in the market.

One thing to think about when deciding between a fixed-rate and adjustable-rate mortgage is how long you plan on staying in your house. Fixed-rate mortgages might be a better fit if you plan on staying in a home for quite some time. Fixed-rate mortgages offer greater stability over time in comparison to adjustable-rate mortgages, but adjustable-rate mortgages might offer lower interest rates upfront. If you aren't planning to keep your new house for more than three to 10 years, though, an adjustable-rate mortgage might give you a better deal. The best loan term is entirely dependent on your personal situation and goals, so be sure to think about what's important to you when choosing a mortgage.

Source